From Collateral to Trust: The Evolution of DeFi Lending with Union Protocol

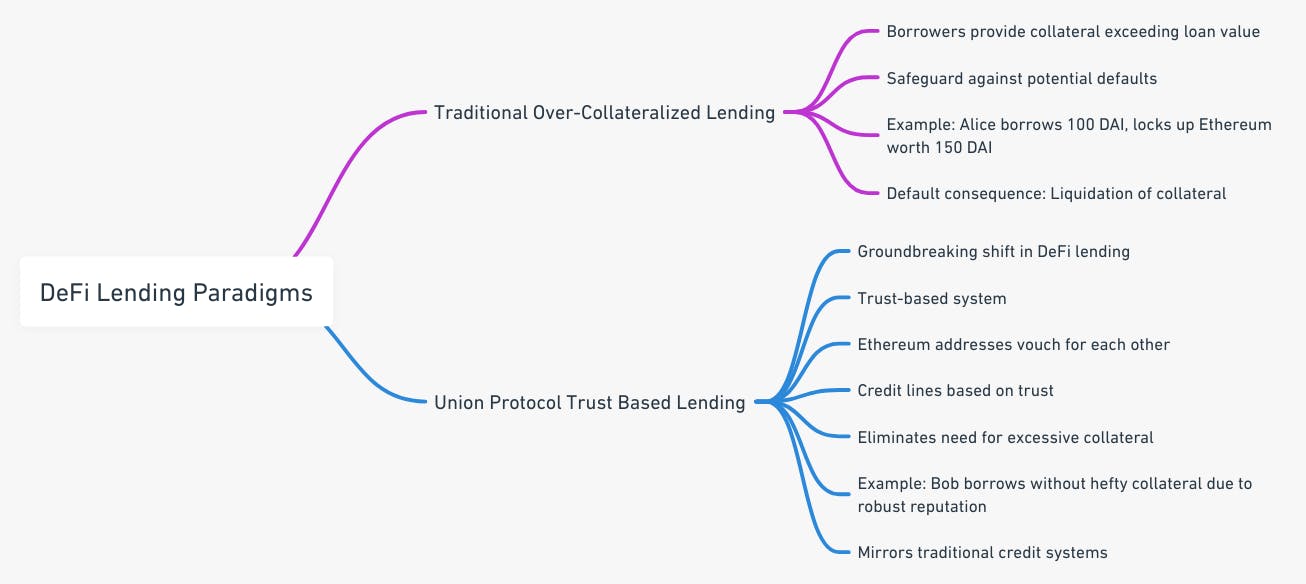

In the realm of decentralized finance (DeFi), lending has emerged as a cornerstone, enabling users to borrow or lend assets in a decentralized manner. Traditional DeFi lending platforms, however, have operated on an over-collateralized model. This model, while secure, can be daunting and less intuitive for those familiar with conventional web2 lending systems.

Traditional Over-Collateralized Lending in DeFi

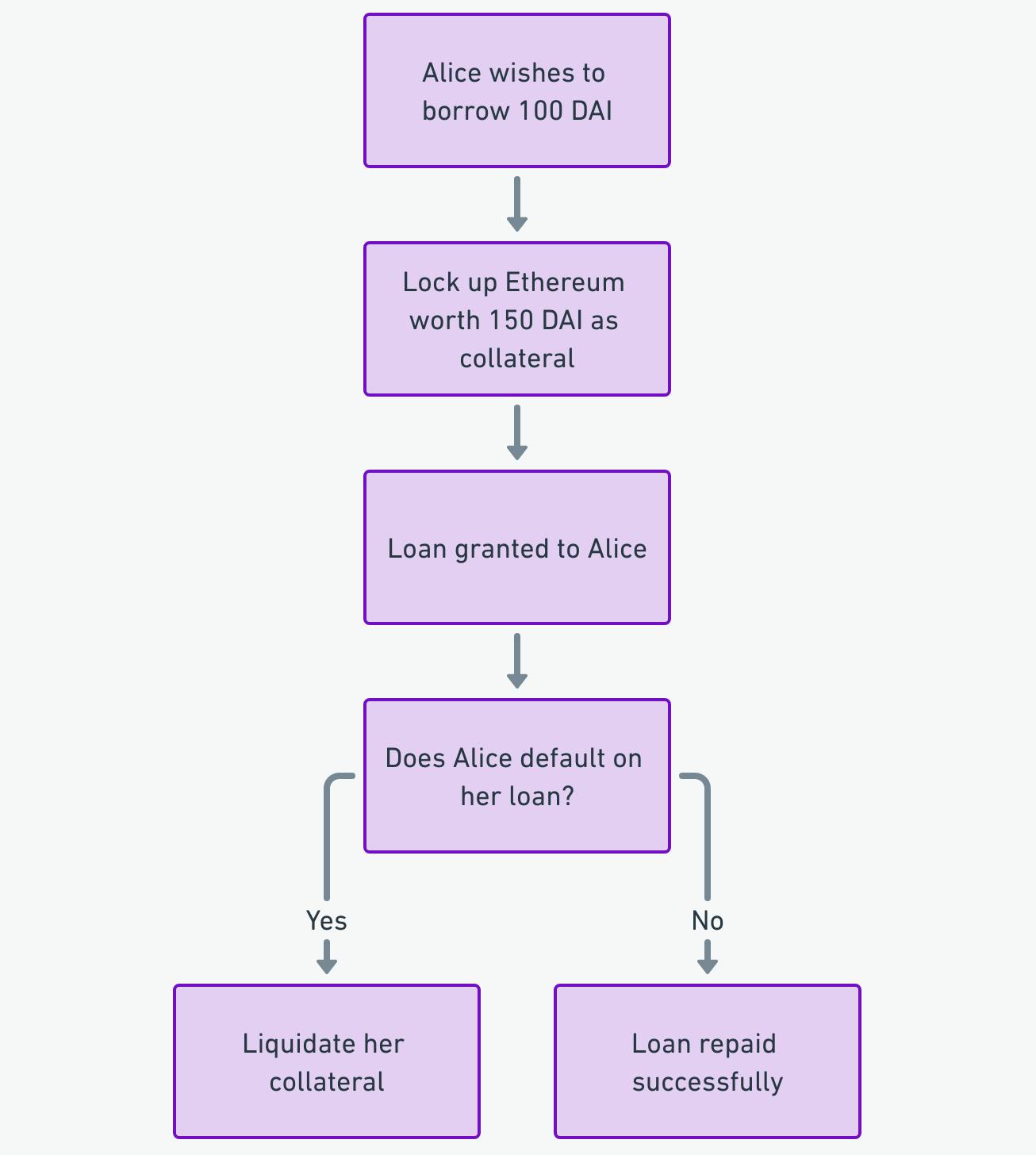

In the traditional DeFi lending paradigm, borrowers are mandated to provide collateral exceeding the value of their loan. This mechanism is a safeguard, ensuring lenders are protected against potential defaults. For instance, if Alice wishes to borrow 100 DAI, she might be required to lock up Ethereum worth 150 DAI as collateral. Should Alice default on her loan, the platform can liquidate her collateral, ensuring the lender's assets are secure.

The Limitations of Over-Collateralization

Over-collateralization, though secure, has its limitations. It requires borrowers to lock up assets worth more than the loan they're taking out. This can be capital-intensive and may deter potential borrowers, especially those who don't have significant assets to lock up. Moreover, it doesn't truly reflect a borrower's creditworthiness or trustworthiness but rather their ability to provide collateral.

Union Protocol's Paradigm Shift: Trust-Based Lending

Union Protocol introduces a groundbreaking shift in DeFi lending. Moving away from the rigidity of over-collateralization, Union champions a trust-based system.

For instance, Bob, having established a robust reputation within the Union community, can borrow without the constraints of hefty collateral. This approach mirrors traditional credit systems, where trust and creditworthiness are paramount.

The Essence of Trust-Based Lending

Union Protocol's trust-based lending moves away from solely relying on collateral. Instead, it introduces a system where Ethereum addresses can vouch for each other, creating a network of trust. This trust is built over time and through interactions within the Union community.

Vouching System: At the heart of Union's trust-based lending is the vouching system. Users can vouch for one another, signaling trust and credibility. This vouching can come in the form of staking tokens or simply endorsing an address.

Creditworthiness: Unlike traditional DeFi platforms that determine loan eligibility based on collateral, Union assesses creditworthiness based on the trust an address has garnered within the network. This means that even users without substantial collateral can access loans if they have built a strong reputation within the Union community.

Community-Centric: Union's approach is inherently community-driven. It fosters a sense of community where members support and vouch for each other, creating a more inclusive and holistic lending environment.

Advantages of Trust-Based Lending

Flexibility: Borrowers aren't constrained by the assets they hold. They can access loans based on their reputation and trust within the community.

Inclusivity: Trust-based lending levels the playing field, allowing even those without significant assets to access credit.

Reduced Liquidation Risks: Since loans aren't solely based on collateral, there's a reduced risk of liquidation due to market volatility.

Community Building: The system fosters a sense of community, with members actively participating, vouching for each other, and building trust.

Union Protocol in Action: Use Cases

Union Protocol's trust-based lending system isn't just a theoretical concept; it's a practical solution that addresses many of the challenges faced by traditional DeFi lending platforms. By emphasizing trust and community engagement, Union Protocol has created a lending environment that's both inclusive and intuitive. Let's explore some of the real-world scenarios where Union Protocol shines.

1. Microloans for Startups

Challenge: Emerging projects and startups in the DeFi ecosystem often face capital constraints. Traditional DeFi lending platforms, with their over-collateralized models, can be out of reach for these newcomers who may not have the required collateral.

Union's Solution: With Union Protocol's trust-based system, these startups can access microloans without the need for hefty collateral. By leveraging the trust they've cultivated within the community, they can secure the funds they need to kickstart their projects.

2. Peer-to-Peer (P2P) Lending

Challenge: Traditional P2P lending in the DeFi space often requires intermediaries to manage and secure the lending process, adding complexity and potential fees.

Union's Solution: Union Protocol facilitates a direct P2P lending environment. Individuals can lend to their peers based on mutual trust, eliminating the need for intermediaries. This not only reduces costs but also fosters a sense of community where members actively support each other.

3. DAO Initiatives

Challenge: Decentralized Autonomous Organizations (DAOs) are community-driven entities that often require funding for various projects. However, pooling funds or accessing traditional DeFi loans can be cumbersome and restrictive.

Union's Solution: DAOs can harness Union Protocol to access funds based on the collective trust of their members. Instead of relying on a single collateral source, the DAO can pool the trustworthiness of its members to secure loans, making the process more democratic and community-centric.

4. Expanding Financial Inclusion

Challenge: One of the significant challenges in the financial world, both centralized and decentralized, is financial inclusion. Many individuals, especially in developing regions, lack access to traditional banking systems and, by extension, DeFi platforms.

Union's Solution: Union Protocol's trust-based system can be a game-changer for financial inclusion. By emphasizing trust over collateral, individuals who previously couldn't access DeFi loans due to lack of assets can now participate based on their reputation and trust within the community.

5. Reducing Liquidation Risks

Challenge: With over-collateralized loans, borrowers face the constant threat of liquidation due to market volatility. A sudden drop in the value of their collateral can trigger a liquidation event, causing them to lose their assets.

Union's Solution: Since Union Protocol's loans aren't solely based on collateral, borrowers face reduced liquidation risks. The emphasis on trust means that even in volatile market conditions, borrowers have a safety net, provided they maintain their reputation within the community.

Union Protocol's Momentum in the DeFi Landscape

Union Protocol has carved a niche in the DeFi arena. Their recent deployment of Union v2 on Optimism underscores their commitment to scalability and enhanced user experience. The platform's ethos of fostering a member-driven network has resonated deeply within the community, leading to a surge in user adoption.

For enthusiasts keen on exploring Union Protocol, the platform offers an intuitive onboarding journey. Newcomers can dive into Union on Ethereum, Arbitrum & Optimism and commence their journey in building an on-chain credit line.

Wrapping Up

Union Protocol's avant-garde approach to DeFi lending bridges the chasm between traditional web2 lending and the decentralized ethos of web3. By centering trust and community engagement, Union ushers in a more intuitive and inclusive lending landscape. As DeFi continues its evolutionary journey, platforms like Union, which prioritize user-centric solutions, are poised to lead the charge.

For a deeper exploration of Union Protocol and its myriad offerings, consider visiting their official website and stay abreast of their latest innovations.